FOCUS BEEF

The livestock-farming and meat sector (Interbev) has been making continuous progress in terms of environmental protection and animal welfare.

Working in tandem with the major NGOs ONG (WWF, FNE, WelFarm, CIWF, and others), in 2017, the livestock-farming and meat sector collectively committed to progress by signing the the Social Responsibility Pact, which corresponds to the ISO 26000 international standard. The first part of the approach concerns environmental preservation, with the goal of using as few non-renewable resources as possible. To that end, 2,000 cattle farmers have already joined Life Beef Carbon, which, in order to reduce the industry’s carbon footprint by 15%, should concern all livestock farmers by the year 2027.

Animal welfare, a topic that is dear to French consumers, is the second part of the Pact. Slaughterhouses are responsible for investing in buildings that are more ergonomic and comfortable, and better lit.

“At least one Animal Protection Officer should be appointed for each slaughterhouse, and everyone in contact with the animals should receive specific animal-welfare training.“

Lastly, the industry is committed to doing its part to encourage responsible, balanced consumption. Labelling for consumers is becoming more complete. All wrapped products now indicate a batch number, a health-inspection stamp, and the animal’s place of birth, slaughter and butchering. In addition, nutritional information, cooking and serving-size suggestion are being provided more and more frequently.

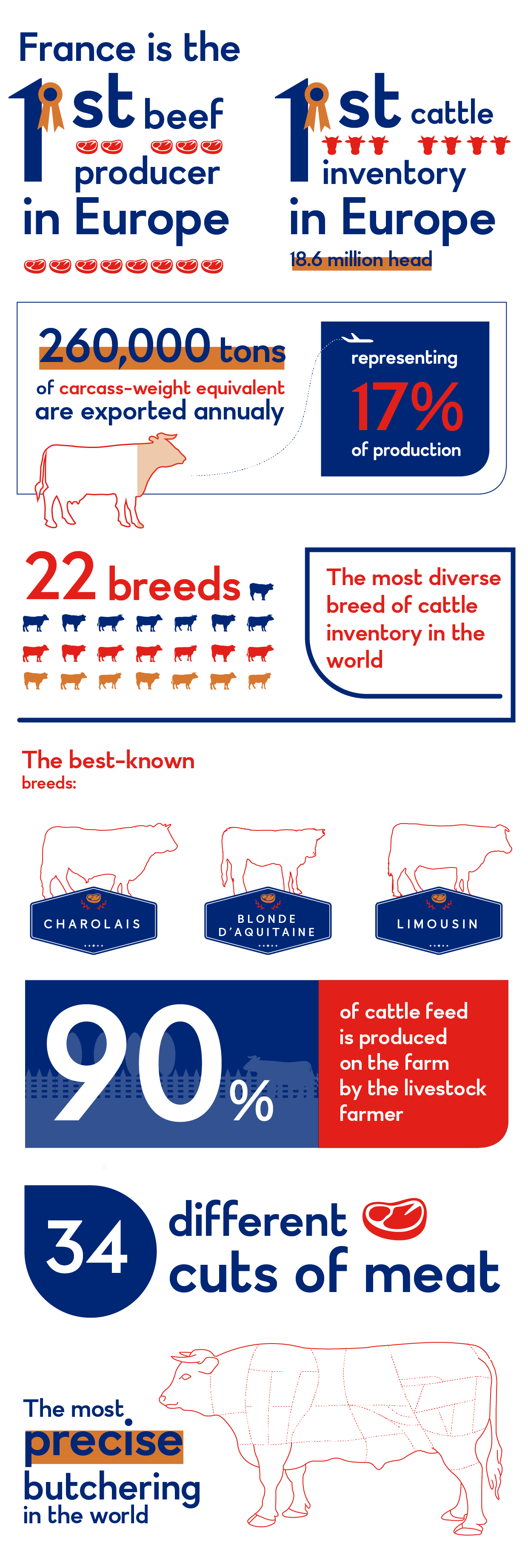

Key figures of Beef Meat sector in France

France is the first beef producer in Europe.

France is the first cattle inventory in Europe, 18.6 million head.

260 000 tons of carcass-weight equivalent are exported annually, representing 17% of production.

France has the most diverse breed of cattle inventory in the world, 22 breeds.

The best-known breeds: Charolais, Blonde d’Aquitaine, Limousin.

90% of cattle feed is produced on the farm by livestock farmer.

France has the most precise butchering in the world : 34 different cuts of meat.

FOCUS PORK

The pork industry: France offers quality and safety

The sector has been showing its credentials to earn consumers’ trust. In France, every pig is identified with a number tattooed on its shoulder that shows precisely where it came from. Veterinary monitoring is performed both before and after slaughtering. Greater efforts for the animals’ well-being, which is becoming more and more important to the general public, is a new focus, and the “Porc français” logo will soon be evolving to include criteria relative to how the livestock is treated.

The sector has already reduced pig’s antibiotic treatments by half.

As an alternative to medication, professionals are doing granulometric analyses of foods, looking at the digestibility and quality of proteins, and even considering the use of clay, essential oils, probiotics or zinc oxide in pig feed.

French hog farmers are working to reduce their environmental footprint. Over the past 25 years, they have already reduced nitrogen emissions by over 40% per animal, and that number reaches 60 to 70% for phosphorus. A growing number of farmers are now using methanation systems that turn manure into biogas that can be used for heat and electricity. They’re truly going hog-wild to protect the environment!

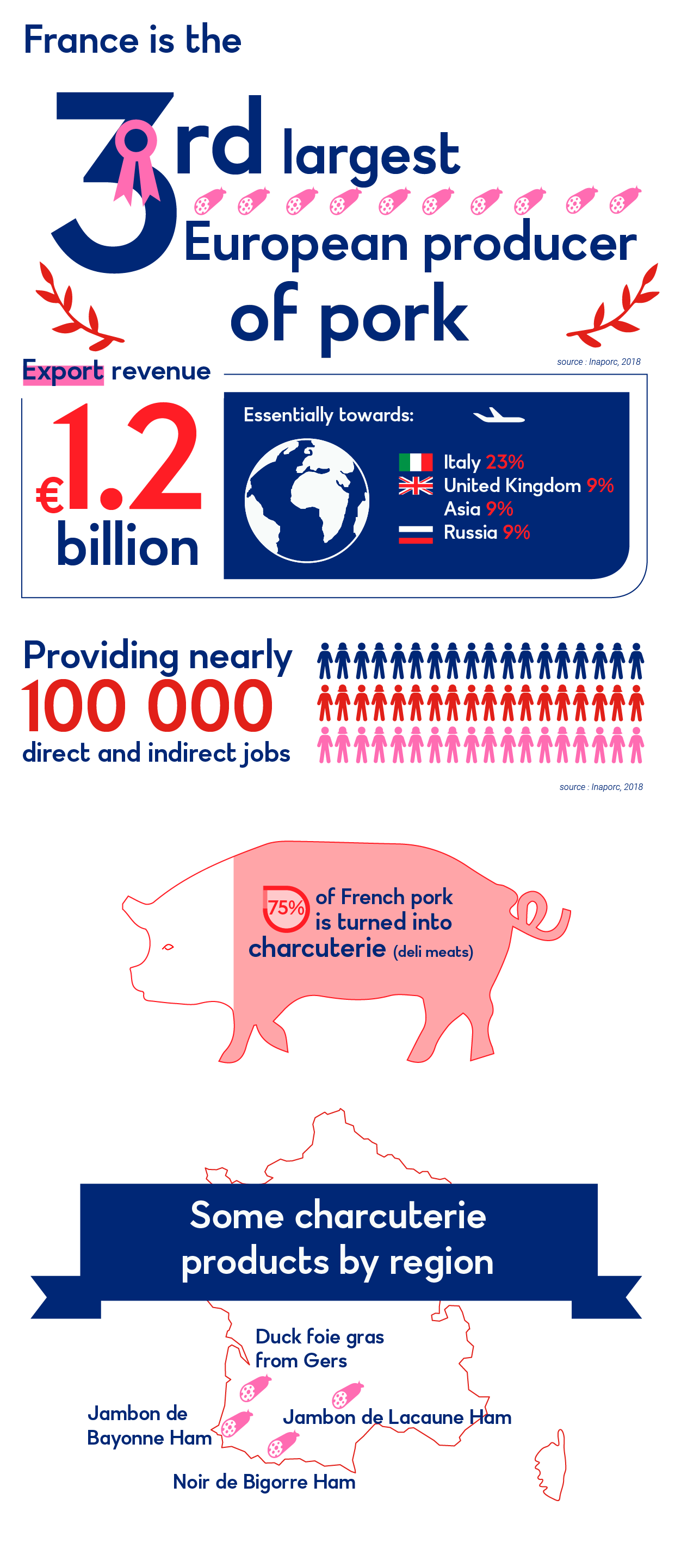

Key figures of Pork Meat sector in France

France is the third largest European producer of pork.

Export revenue of Pork sector in France is 1.2 billion euros.

Leading export markets are :

Italy 23%

United Kingdom 9%

Asia 9%

Russia 9%

Pork sector provides nearly 100 000 direct and indirect jobs.

75% of French pork is turned into charcuterie (deli meats).

Some charcuterie products by region:

Duck fois gras from Gers

Ham from Lacaune

Noir de Bigorre Ham

Ham from Bayonne

FOCUS POULTRY

Better conditions for French hens

Despite the competition from low-cost countries, the French poultry sector still appeals to consumers who care about the quality of what they eat. The industry leader will soon be building a processing site in Brittany, where it intends to invest €160 million over the next few years. We’re crowing with pride! But the growth of the poultry-farming industry is taking place in a thoughtful way.

French poultry farmers commit to improving living conditions for hens.

With the Ambition Anvol 2025 pact, the entire poultry sector is committing to acting responsibly. It has promised to provide access to natural light for more than 50% of broilers by 2025. It will reduce antibiotic use by 60%, relative to 2011 rates, by 2025. And finally, it will modernize its slaughterhouses and renovate 10% of its buildings a year.

“Egged on” by animal-advocacy groups like Welfarm and L214, several corporations in the sector have signed the European Chicken Commitment, which implements a maximum stocking density of 30 kilograms of animal weight per square meter, third-party auditing, stunning before slaughter, and more.

These promises represent an undeniable financial effort that can increase the price per hen by up to 60%.

So the industry is aligned with the logic of the government stimulus plan, which aims to meet the expectations of consumers who are concerned with how the animals that wind up on their plates are treated. France wants to be able to stand as proudly as its iconic rooster!

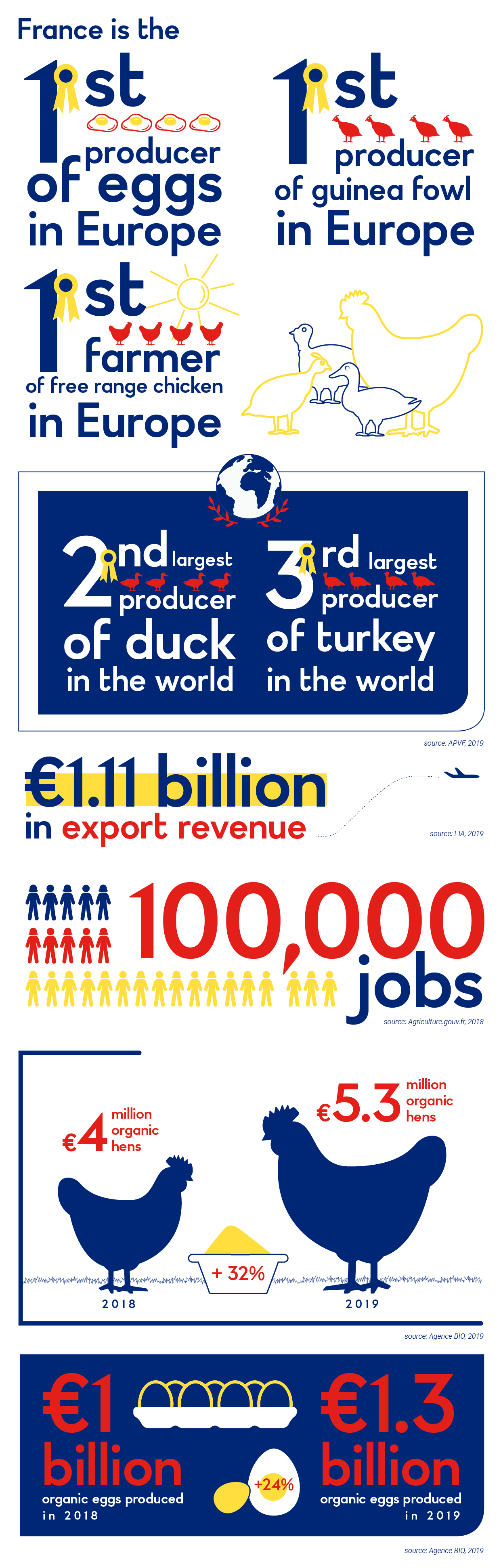

Key figures of Poultry and Egg sector in France

France is the first producer of eggs in Europe.

France is the first producer of guinea fowl in Europe.

France is the first farmer of free range chicken in Europe.

France is the second largest producer of duck in the world.

France is the third producer of turkey in the world.

Exportation revenue of Poultry and Egg sector in France is 1.11 billion euros.

The sector provides 100 000 jobs.

In 2019, there were 5.3 million organic hens.

In 2019, there were 1.3 billion organic eggs produced.