FOCUS WINE

While it has nothing left to prove on the high end of the market, the sector has been seeking to get back into the race in terms of mid-range and inexpensive wines.

Having started out with supply-based marketing, promoting the many geographic appellations, it is now turning towards demand-based marketing, focused on developing strong global name-brand recognition, like its competitors on the export market: the U.S.A., Chili and New Zealand.

“The sector is also determined to achieve a true ecological transition“

Coming up with reliable alternatives to plant-protection products

The long-term goal is to become completely free of plant-protection products, but that will require coming up with reliable alternatives. Concretely, the goals are to reduce the use of those products by 50% by the year 2025, to develop the use of alternative products, and to establish a principle of avoiding the most dangerous ones. Scientific research is contributing to that by developing innovative equipment for spraying, as well as creating systems for evaluating risk and improving vineyard health management.

Facing water scarcity

Water availability may well be the next great challenge, depending on the evolution of climate change. Bearing that possibility in mind, the sector is already developing genomic selection and phenotyping tools in order to promote higher tolerance for water scarcity.

All of those issues provide opportunities for accelerating changes that already run deep, in tune with environmental challenges and evolving global consumer demands.

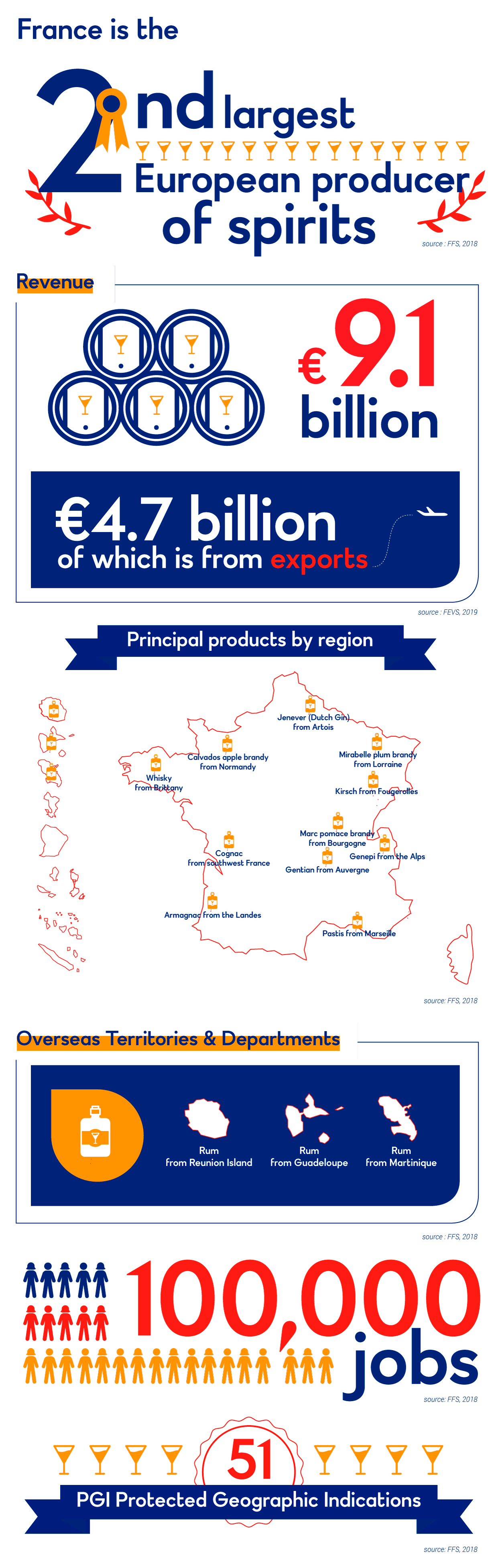

Key figures of Wine sector in France

France is the second largest producer in the world by volume.

Production revenue of Wine sector in France is 12 billion euros.

Export revenue of Wine sector in France is 13 billion euros.

Wine sector in France provides nearly 500 000 direct and indirect jobs.

Leading export markets are :

USA €3.4 billion

UK €1.3 billion

China €0.9 billion

Singapore €0.9 billion

Germany €0.8 billion

Main products are :

Champagne

Loire Valley wines

Alsacian wine

Burgundy wine

Bordeaux wine

Rhône Valley wines

Provence wines

Pays d’Oc wines

Corsican wines

FOCUS SPIRITS

French spirits are being reinvented

While France glitters on the international stage thanks to its fabulous, high-end wines, French spirits, exported to every corner of the globe, are every bit as representative of the country’s art de vivre.

World renowned cognac and vodka are the two largest export categories. They are followed by rum and liqueurs; the super-premium trend has contributed to revealing the excellence of France’s production.

The mixology revival is also benefitting French producers, who are reinventing their products and attracting growing renown at numerous international competitions. The diversity of French spirits, which highlight the agricultural products they are made from, allow for bold innovation. Iconic spirits associated with particular regions, such as Armagnac and Calvados, are now well-established in cocktail bars.

In addition, connoisseur tourism is growing, with over 2 million tourists welcomed by more than 120 producers offering curated visits including encounters with professionals, sensorial experiences, and workshops.

A responsible and committed sector

In 2019, the French Spirits Federation (FFS) deepened its members’ commitment to responsible drinking by initiating the founding of “Prevention and Moderation” along with Brewers of France and the French Federation of Aperitif Wines. The organization promotes drinking alcoholic beverages responsibly through prevention, promotion, and commitment actions for professionals.

The sector’s social responsibility also requires that it reduce its environmental footprint. To that end, FFS has signed the “Charte Verre” (Green/Glass Charter), which aims, alongside other committed stakeholders, to collect and recycle 90% of glass packaging by 2025, and 100% by 2029.

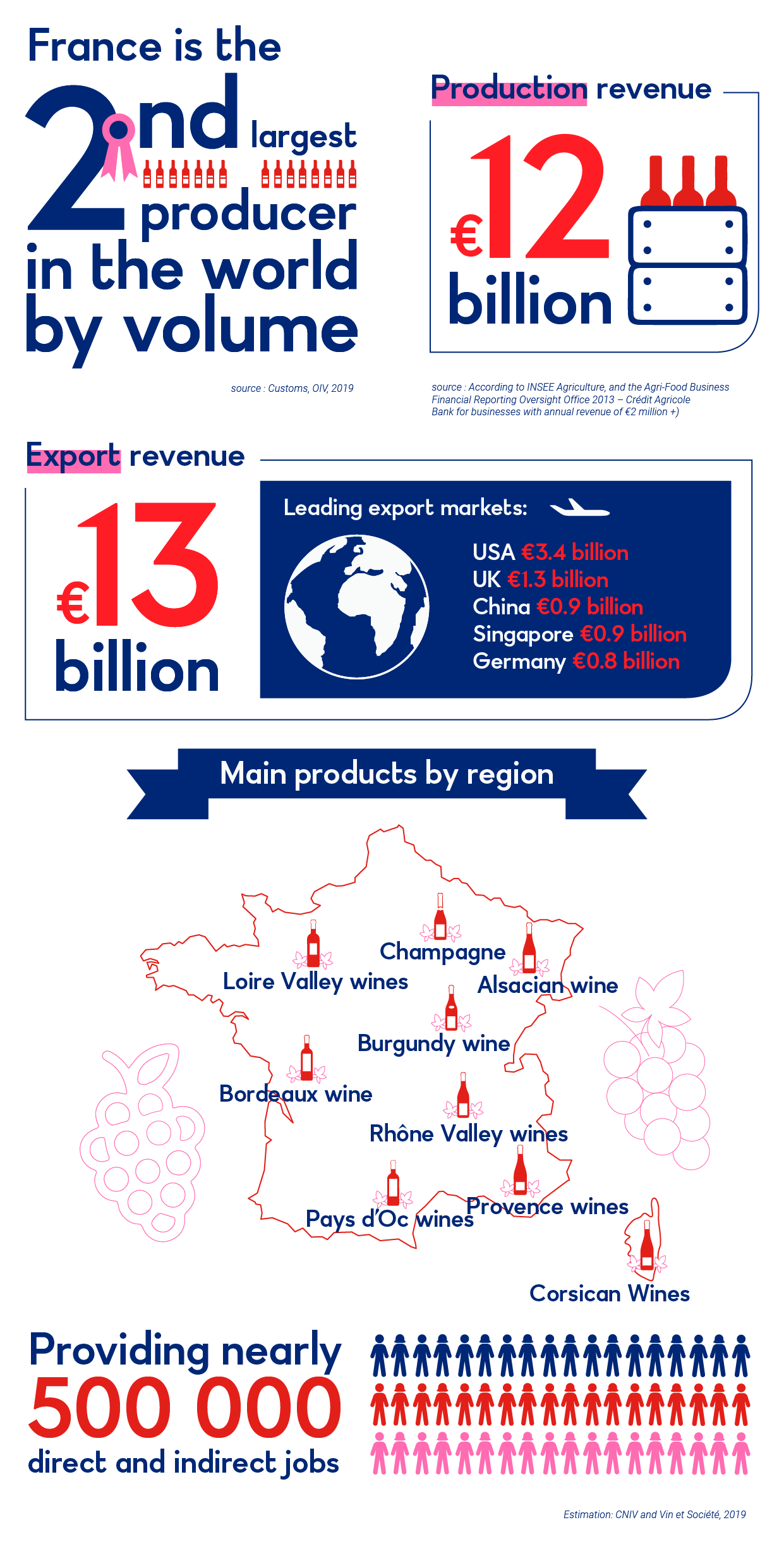

Key figures of Spirits sector in France

France is the second largest European producer.

Revenue of Spirits sector in France is 91 billion euros. €4.7 billion of which is from exports.

Spirits sector in France provides nearly 100 000 jobs.

There are 51 Protected Geographic Indications (PGI).

Main products are :

Jenever (Dutch Gin) from Artois

Calvados apple brandy from Normandy

Mirabelle plum brandy from Lorraine

Whisky from Brittany

Kirsch from Fougerolles

Marc poace brandy from Bourgogne

Cognac from southwest France

Genepi from the Alps

Gention from Auvergne

Armagnac from the Landes

Pastis from Marseille

Rum from Reunion Island

Rum from Guadeloupe

Rum from Martinique